Our Story

Our Story

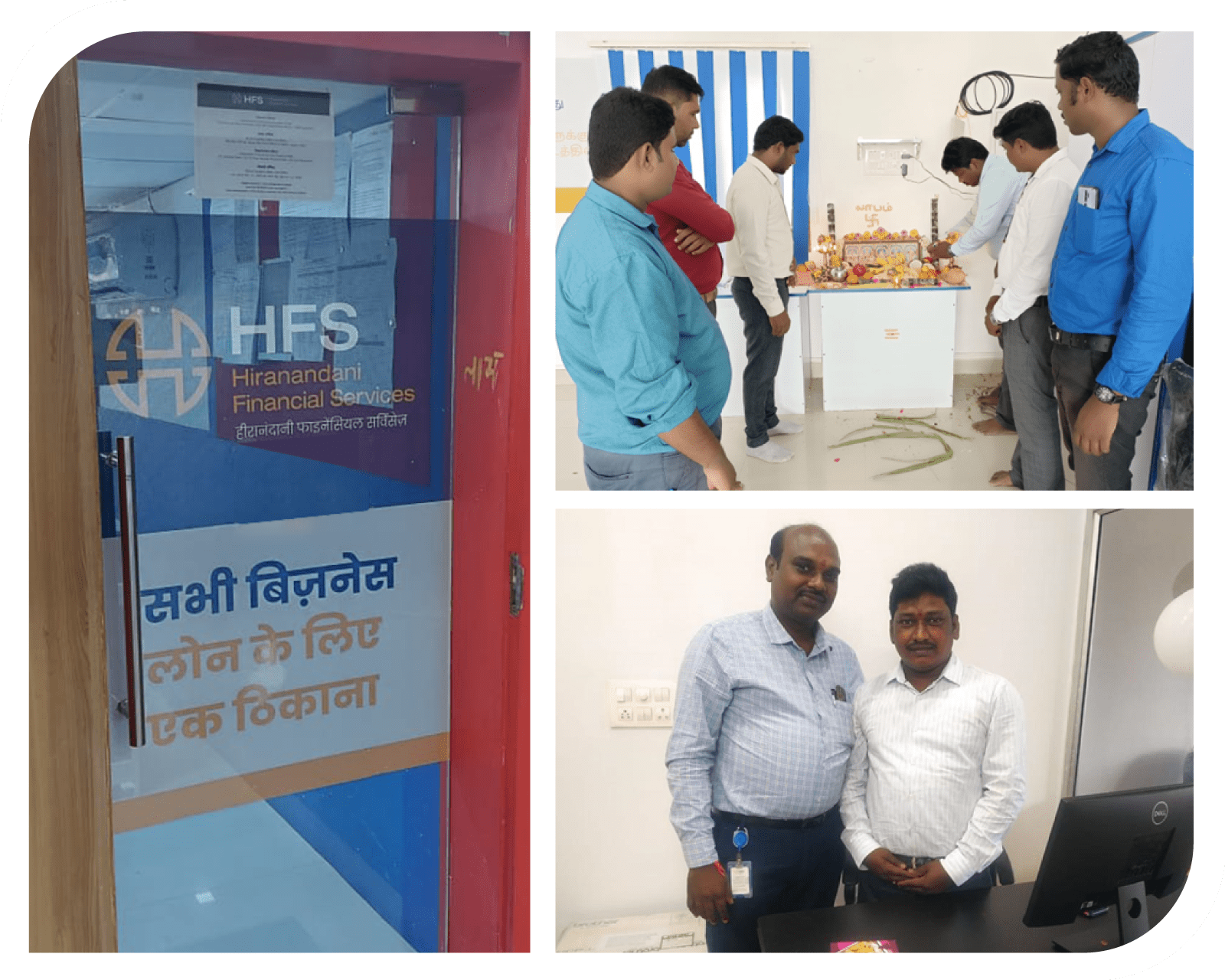

Hiranandani Financial Services is a new age NBFC backed by a leading

conglomerate – House of Hiranandani, a brand that is associated with

excellence and strives to create value for all stakeholders, every step of the way.

The MSME sector of India is growing rapidly and forms the backbone of the country’s economic and self-sustainable goals. With millions of business dreams driving this sector, timely financial support and trustworthiness is required for their expansion.

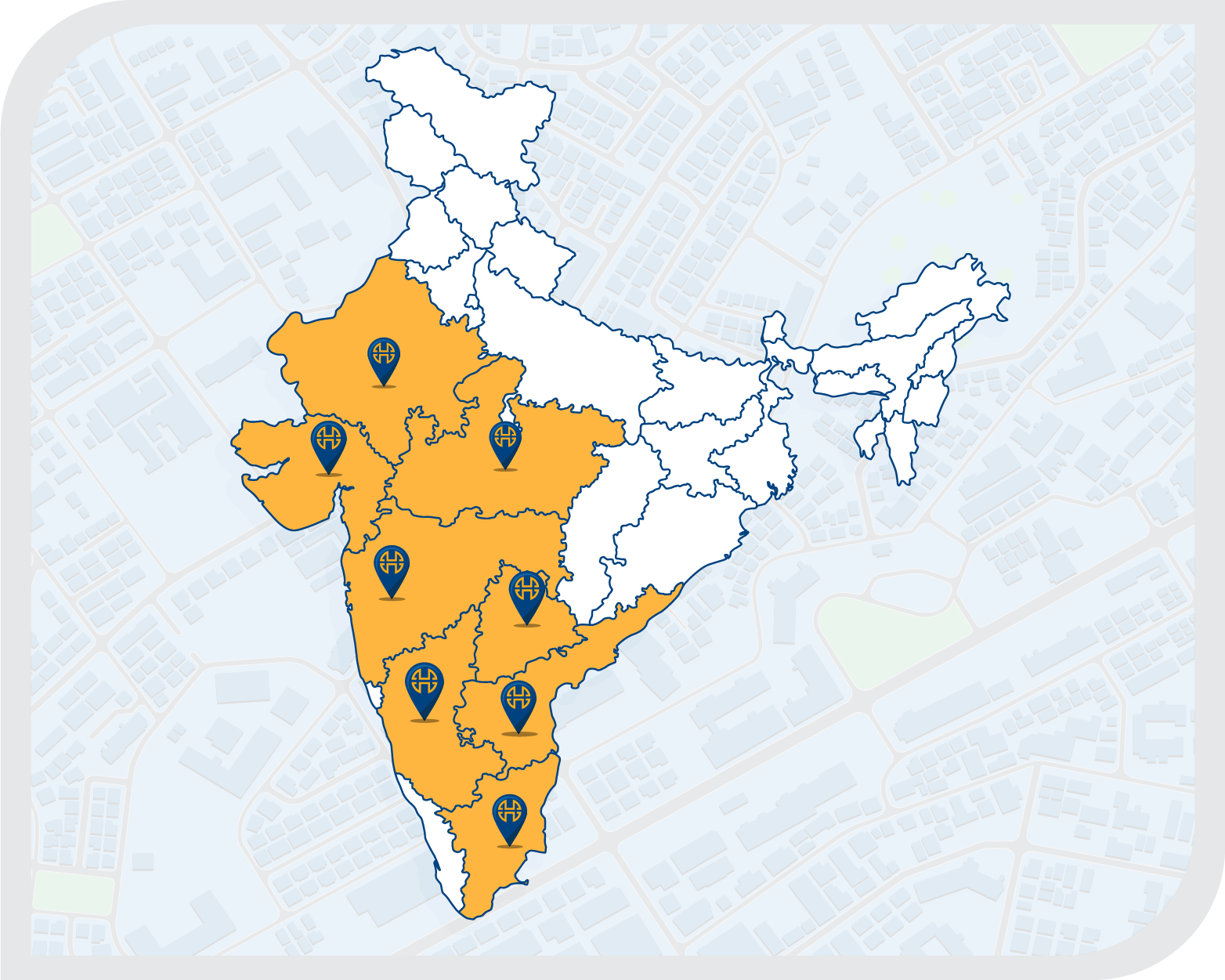

At HFS, we aim to fulfil the growth needs of micro and small enterprises in India in a seamless and transparent manner through tailor made financial products that help in fulfilling their business ambitions. We currently serve micro and small businesses in nine states through 121 branches, and we’re committed to continuing our expansion.

Hiranandani Financial Services is a new age NBFC backed by a leading

conglomerate – House of Hiranandani, a brand that is associated with

excellence and strives to create value for all stakeholders, every step of the way.

The MSME sector of India is growing rapidly and forms the backbone of the country’s economic and self-sustainable goals. With millions of business dreams driving this sector, timely financial support and trustworthiness is required for their expansion. At HFS, we aim to fulfil the growth needs of micro and small enterprises in India in a seamless and transparent manner through tailor made financial products that help in fulfilling their business ambitions. We currently serve micro and small businesses in eight states through 70 branches, and we’re committed to continuing our expansion.

We stand for trust,

and transparency

- Our Vision

MSMEs

We Serve

To maintain the highest level of governance, sound business practices and a firm commitment to credit standards. We intend to be a customer-centric organization and offer a unique value proposition to every customer as per their requirements.

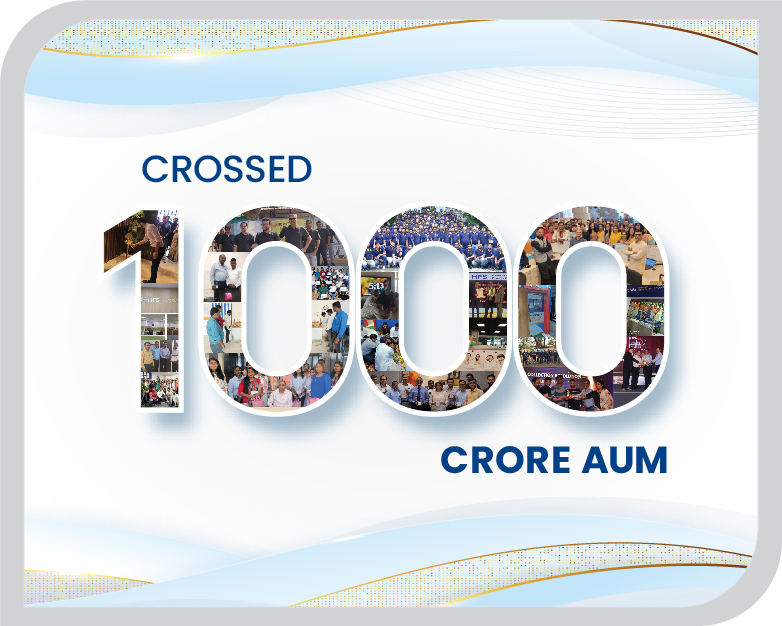

Our journey of excellence